Enough experts David Sullivan and Noel Atama assess the conflict minerals trade in Congo based on firsthand field research.[1]

AP Photo / Riccardo Gangale

Thanks to increased international attention, including strong statements by U.S. Secretary of State Hillary Clinton during her visit to eastern Congo, all of the actors with a role in Congo’s conflict mineral drama are feeling the pressure to change their behavior. Actors in the private sector both within Congo and in the international supply chains for electronics and other industries have signaled a willingness to provide new levels of due diligence and corporate responsibility. Yet it is equally clear that a number of actors remain highly invested in business as usual with regard to conflict minerals, and that palpable change on the ground can be the only barometer of true success.

Congo's minerals leave a trail of destruction as they travel from the mines to the phone in your pocket.

Situation update—Kimia II’s impact on the minerals trade

The battle for Bisie: Eastern Congo’s largest mine

From FDLR to FARDC, the behavior remains the same

Impacts on the ongoing minerals trade

Congolese and international efforts to reform the mineral trade

The Congolese Government

The stabilization plan

Private-sector efforts

Conclusion

Endnotes

[pagebreak]

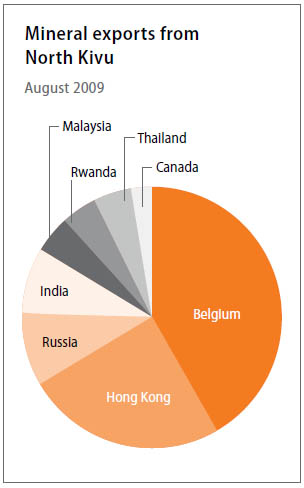

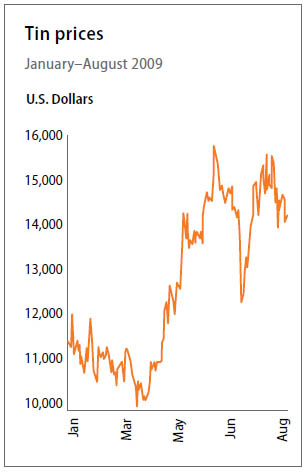

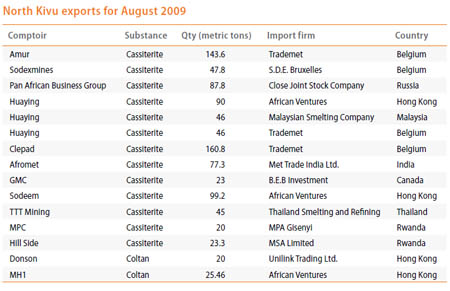

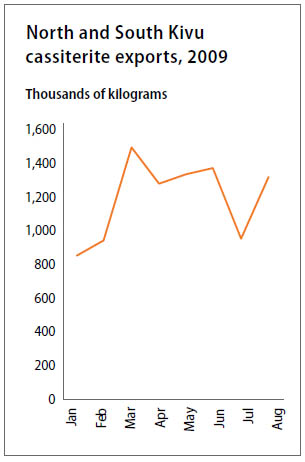

Appendix: North and South Kivu mining export data

|

|

Source: Division of Mines, North/South Kivu. |